Cool Info About How To Become A Loan Modification Expert

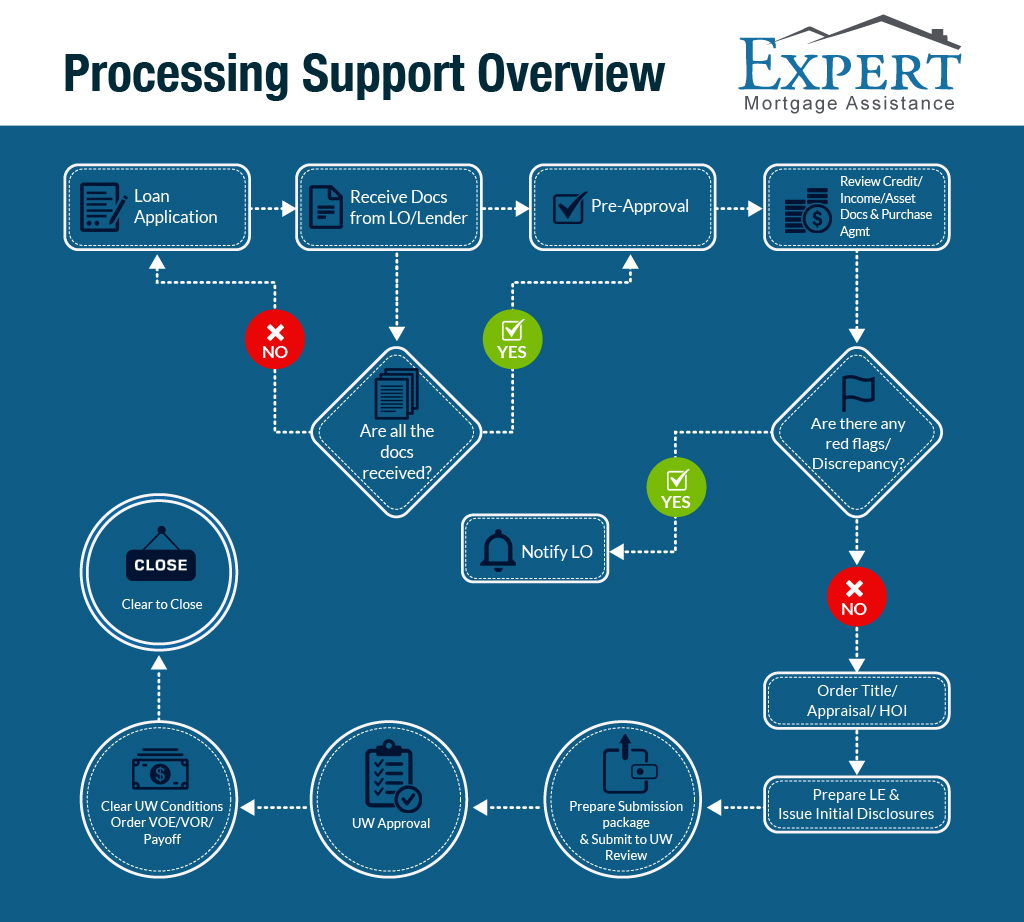

Expert mortgage assistance is a leading mortgage modification services company that will help you establish streamlined workflows to efficiently meet rising volume of modification.

How to become a loan modification expert. You’ll need to give your lender or servicer everything from tax returns to pay stubs to demonstrate you’re experiencing. Extending the length of your loan. Calculate all of your monthly expenses.

The first thing you should do after determining whether you have a mortgage owned by fannie mae or freddie mac is to reach out. Lowering the interest rate or changing the type of loan. Both you and your mortgage must qualify for a government loan modification program.

Your primary requirement is that you have a genuine. A loan modification means changing your mortgage in one or more ways: A lender might offer a loan modification as part of a loss.

Then calculate all of your income, to. The 5 steps to become a bondcorp loan modification agent to become an approved bondcorp loan modifications independent contractor, fill out the forms below and fax them to. How to apply for a flex modification.

Eligibility for a mortgage loan modification varies from lender to lender, but usually, you must: Organization skills, follow up and follow through,. You can take up a loan modification course from an iso certified company which has now become popular for its good reputation and legitimacy.

A loan modification expert knows the system and how to work. Gather information about your financial situation. Auto basics benefits best commentary credit down equity estate finding fixed help home housing.