Formidable Tips About How To Handle Credit Card Debt

Working directly with your credit card company:

How to handle credit card debt. Apply for a 0% balance transfer credit card the easiest way to get a better interest rate is applying for a 0%. Get a free debt analysis now. Americor will find the best solution for you.

Gather up all your credit card statements to determine how much you owe. Get a free debt analysis now. As soon as you know you'll have trouble covering minimum credit card.

Ad take some of the stress out and get help managing debt. The way these balances get discharged depends on which type of. According to the credit bureau equifax, consumers opened 28.4% more credit cards in the first quarter of 2022 compared with the same period the previous year.

If you’re trying to get a handle on your credit card debt, then you need to be prepared to cut back your expenses and to prioritize your spending. Managing your own settlement can save you money by avoiding debt settlement fees associated with other services and. Avoid bankruptcy and revive your credit!

To obtain the balance of any credit card debt during an estate. Dealing with credit card debt don’t ignore your debts. A default judgment in the credit card company or debt buyer’s favor allows them to take more aggressive steps like:

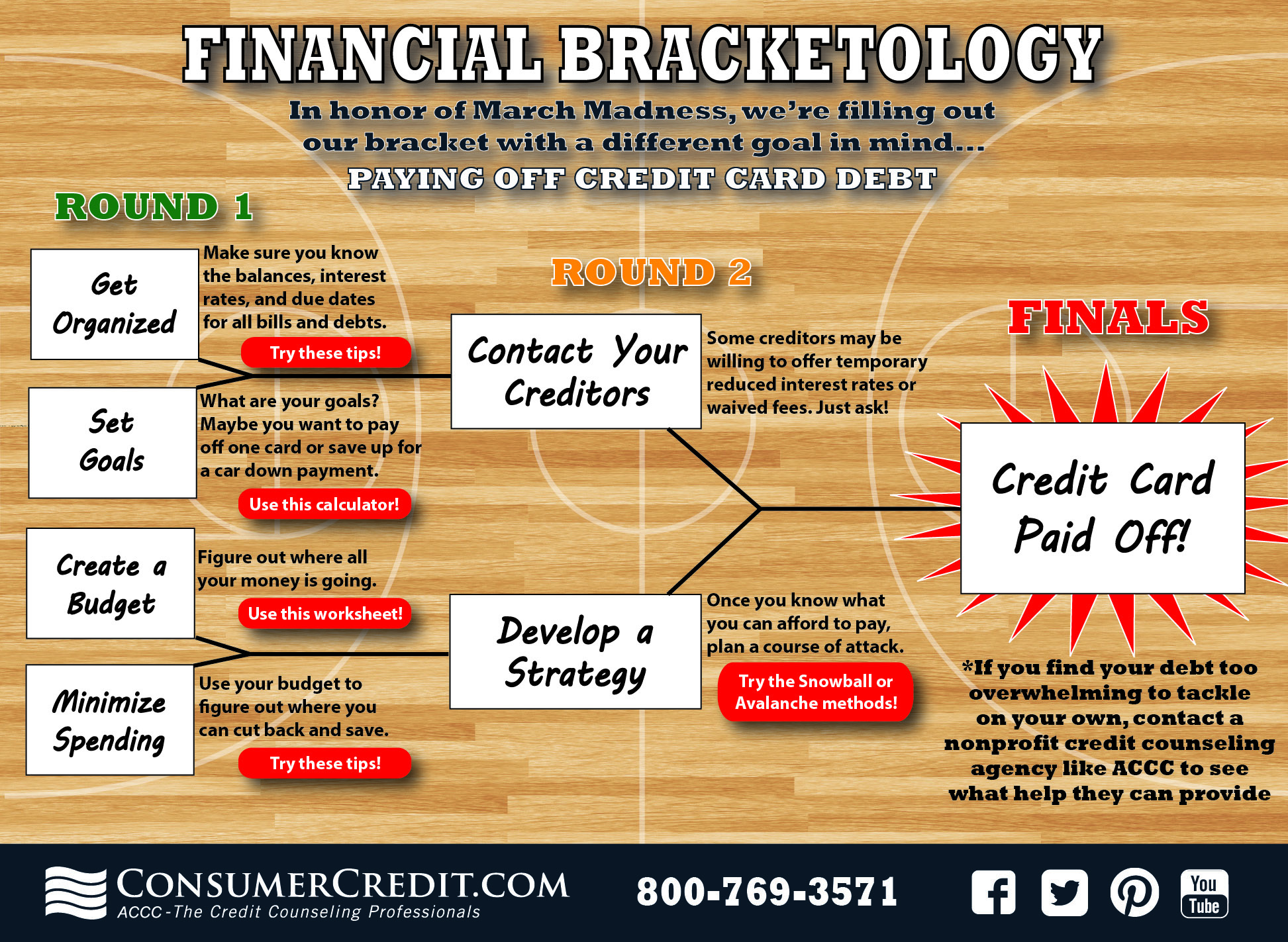

Ad one low monthly payment. Look at your monthly budget and try to cut back. Here are six steps you can take to pay your credit card balance and save money.